Banks "clean up" balance sheets/Non-performing loans approach 4%, the lowest level since 2008

The non-performing loan rate, one of the most important indicators of banking financial health, has suffered a further decline during the second month of the year, official figures from the Bank of Albania show. During February of this year, the weight of non-performing loans to total loans decreased to 4.06%, from 4.12% in January and 4.17% in December of last year.

The February decline has brought the ratio of problem loans to total to the lowest level since 2008. This decline comes at a time when the economy is experiencing rapid credit growth.

On an annual basis, the non-performing loan rate has decreased by 0.63 percentage points, reflecting further improvement in lending quality.

Scan Intel's analysis of financial data shows that other lending ratios have not followed the same downward trend. Specifically, the ratio of non-performing loans net of provisions to regulatory capital rose to 4.61%, from 4.26%, while the ratio of non-performing loans net of provisions to shareholder capital increased to 3.95%.

On the other hand, deposits, loans and total assets have increased, while non-performing loans have continued to decline, reaching a new minimum record.

As predicted, the continued decline in non-performing loans not only signals a healthy banking sector, but also reflects the improvement in the solvency of individuals and businesses to meet their obligations to loans taken from financial institutions, especially banks./ SCAN

Happening now...

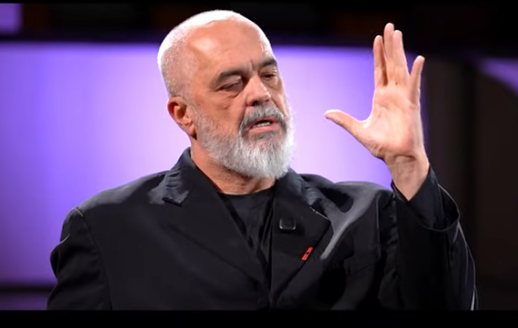

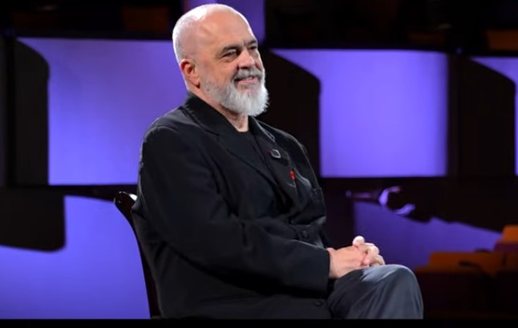

83 mandates are not immunity for Rama's friends

ideas

"Preliminary sentence for Belinda Balluku", response to Baton Haxhiu

Teatri që fsheh prapaskenën

Berisha's red line and the black line of democracy in the DP

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128