IMF explains the reasons for the strengthening of the Lek: The volume of the foreign exchange market in Albania reaches 11 billion dollars! The fall of the Euro would be greater if…

The shallowness of the Albanian foreign exchange market may justify the occasional interventions of the Bank of Albania to maintain exchange rate stability.

A study by experts from the International Monetary Fund (IMF) estimates that, in cases where markets are shallow, financial intermediaries may have limited capacity to absorb excess demand or supply for currency.

These shocks can cause significant deviations of the exchange rate from the fundamental value, with implications for macroeconomic and financial stability.

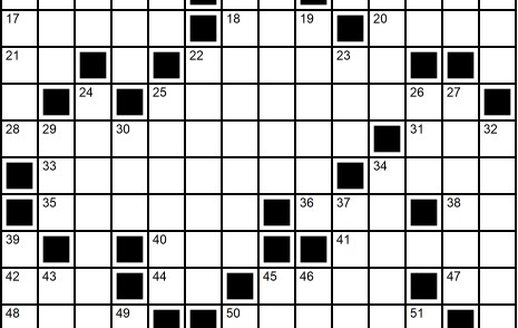

IMF experts emphasize that, with an annual volume of around 11 billion US dollars, the foreign exchange market in Albania can be considered shallow compared to the average turnover in emerging markets, of around 52 billion dollars per year.

For the first time, last year the Bank of Albania undertook a long-term intervention in the domestic foreign exchange market, with the aim of curbing the further appreciation of the Lek.

The Central Bank purchased approximately 933 million euros in the domestic foreign exchange market in 2024. The amount of foreign exchange purchased increased by 249% compared to the previous year.

The total value of purchases includes planned purchases, aimed at increasing foreign exchange reserves, but also those related to direct market interventions, aimed at preventing further decline in the exchange rate.

Planned purchases, in order to increase the foreign exchange reserve, actually constituted only a minority of the total amount purchased. Last year, they reached a value of 283.8 million euros, an increase of 14% compared to the previous year.

Meanwhile, direct purchases, aimed at preventing further decline in the Euro-Lek exchange rate, reached a record amount of 649 million euros. For the first time last year, the Bank of Albania undertook a long-term intervention in the foreign exchange market, with the objective of preventing further strengthening of the local currency.

Direct purchases began in May and continued until December, with a temporary interruption in September. The month with the highest value of purchases was October, when the Central Bank purchased 169.4 million euros in the domestic foreign exchange market.

The average Euro-Lek exchange rate last year suffered a 7.4% decline compared to 2023. In the absence of Bank of Albania interventions, the decline in the Euro-Lek exchange rate would have been even greater.

The IMF experts' analysis concludes that the exchange rate should continue to play its role as a shock absorber for external shocks to the economy, and interventions in the free exchange rate should only be used to mitigate the impact of shocks resulting from non-fundamental factors.

IMF valuation models show that the appreciation of the Lek has historically been driven primarily by fundamental factors, while non-fundamental transitory factors have played a modest role in some episodes.

The study recommends maintaining a free exchange rate regime, relying on interest rate policies as the main tool for price stability.

In cases of non-fundamental shocks, the analysis suggests that interventions can be beneficial, reducing inflation volatility.

However, authorities should carefully assess the potential adverse effects of interventions (and of further accumulation of foreign exchange reserves), including risks to the central bank's balance sheet, interest rate transmission, and financial market development./ Monitor

Happening now...

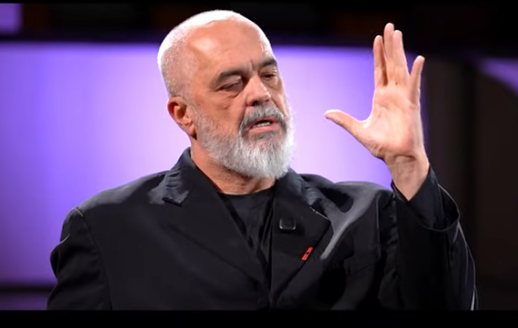

83 mandates are not immunity for Rama's friends

ideas

"Preliminary sentence for Belinda Balluku", response to Baton Haxhiu

Teatri që fsheh prapaskenën

Berisha's red line and the black line of democracy in the DP

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128