Almost half of home loans, the real estate market scares banks. If there are fluctuations, they are directly at risk! BoA with a plan of measures: We can limit loans

The rapid increase in real estate prices is worrying the banking sector, which considers this market as the third most important risk to their activity, after external shocks and the risk of cyberattacks. A rapid decline in the sector accompanied by a decrease in solvency could harm the banking sector, due to their high exposure.

This exposure is being carefully assessed by the Bank of Albania with the aim of protecting banks from the risk of business bankruptcy or inability of citizens to repay loans.

Specifically, the ceiling for the value of the loan that banks can provide in relation to the collateral is being assessed. Currently, banks finance up to 70% of the property value, but according to information in some banks, this level reaches up to 100%.

There may also be a ceiling on the level of debt an individual or business can have relative to total income or a limit on the percentage of debt service relative to income.

Another point being assessed is related to the limitation of loan maturity, currently loans for individuals have repayment terms of up to 30 years, and the application of additional conditions for loans for the purchase of a second or third home for investment purposes is being considered. These policies can also be defined by currency.

These conditions that the Bank of Albania may undertake will be determined according to the exposure that each bank has to this sector.

The Bank of Albania says that 46% of the credit provided by banks is collateralized in real estate, increasing by 9% compared to 2023. Translated into value, 390 billion lek are collateralized in properties, 50% or 195 billion lek belongs to individuals and 190 billion lek belongs to businesses.

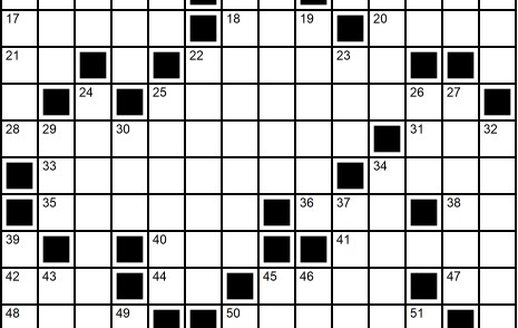

MEASURES THAT THE BOA MAY TAKE

- Ceiling on the value of the loan in relation to the collateral

- Ceiling on the debt service in relation to income

- Ceiling on the level of debt to total income

- Limitation on the level of loan maturity

- Limitations according to the currencies in which the loan is taken

- Limitations on second or more loans

/ shqiptarja.com

Happening now...

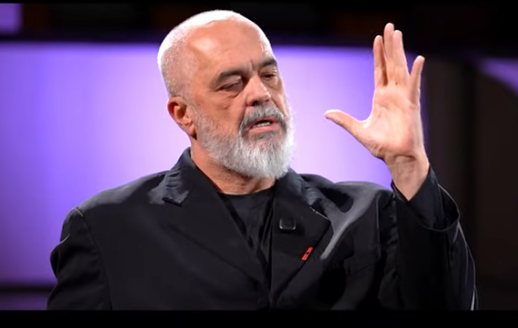

83 mandates are not immunity for Rama's friends

ideas

"Preliminary sentence for Belinda Balluku", response to Baton Haxhiu

Teatri që fsheh prapaskenën

Berisha's red line and the black line of democracy in the DP

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128