From agreed taxation to business debt forgiveness, how will "Fiscal Peace" work! Here are the three main pillars

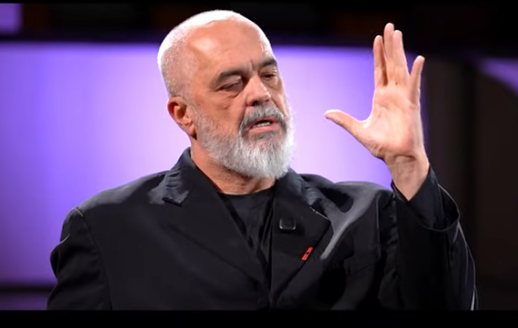

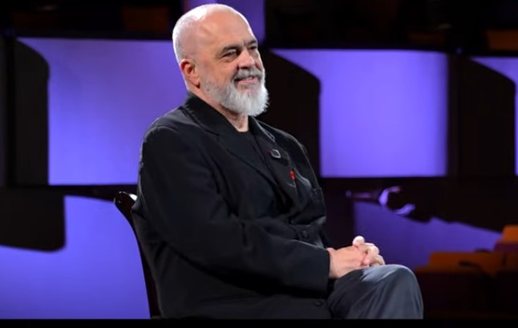

In a meeting with representatives of tourism sector businesses in Shëngjin and Velipojë, the minister announced that this initiative aims to support the formalization of economic activity and ease the tax burden for enterprises operating in the country, including the forgiveness of unpaid obligations, fines and interest on arrears up to 10 years ago.

The Minister said that an agreement has been proposed for entities operating in the hotel sector, due to the significant increase in tourism revenues, but also the presence of informality in the sector. In this agreement, according to her, operators agree to declare the occupancy of accommodation structures at 65% during the summer season and 35% during the winter season.

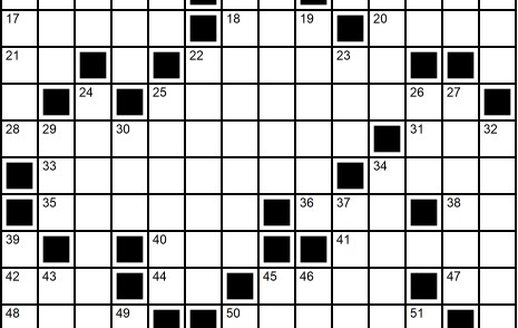

"In the first days, 600 businesses signed the tax agreement, while currently the number has reached over 1 thousand. Those who accept the agreement are exempted from tax inspections and decide on the declared amount themselves based on the instructions of the tax administration", - Ibrahimaj stated. The Minister emphasized that the "Fiscal Peace" is also proposed to function along the same lines, which will be extended to all businesses in the country, after the tax agreement and consists of three main components.

For debts older than 10 years, the obligation, interest and late fees will be deleted. For obligations from 5 to 10 years, if the business pays 50% of the principal debt, the rest will be deleted. For businesses that cannot pay immediately, the option of a 12-month agreement and the benefit of forgiveness of up to 25% of the obligation will be offered. While for obligations from 1 to 5 years, fines and late fees will be deleted if the principal obligation is paid.

"Taxes will calculate the average net profit of the last 3 years of the business and multiply it by a coefficient that reflects economic developments in the relevant sector. The tax on this amount will be 15%. If the business declares a higher profit than the proposed one, it will be taxed at only 5%. The agreement with the tax authorities on the agreed profit tax will avoid tax audits," Ibrahimaj underlined.

By reviewing financial statements for the last 5 years, businesses can improve their balance sheets by paying only 5% of the amount for each corrected item.

"Reviewing balance sheets is a necessity for most businesses and is also the second component of 'Fiscal Peace'. They give every business the right to adjust its financial statements by closing a past chapter and opening a new one for the future. To review each balance sheet item, the business will pay only 5% of the obligation for each revised item."

1. Agreed tax on profit.

2. Review of financial statements (last 5 years)

3. Forgiveness of tax liabilities and interest on arrears

Happening now...

83 mandates are not immunity for Rama's friends

ideas

"Preliminary sentence for Belinda Balluku", response to Baton Haxhiu

Teatri që fsheh prapaskenën

Berisha's red line and the black line of democracy in the DP

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128