Real Estate/New Property Tax Reform, How Costs Increase and Sales Slow Down

Albania has officially launched the implementation of a new real estate tax reform, an initiative that aims to create a modern and transparent property taxation system, based on the real market value. The reform is expected to strengthen the role of municipalities in revenue collection and bring the country closer to European Union standards.

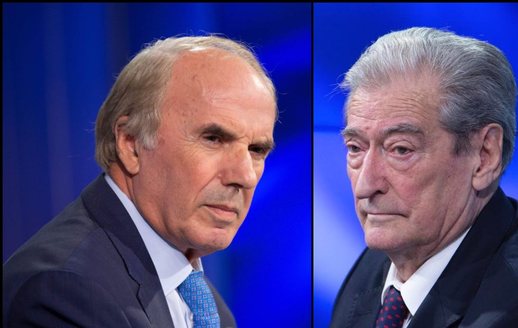

Invited to the show "Good Morning Albania" on RTSH1, real estate appraiser Ervin Demirxhiu emphasized that the new changes have brought immediate impacts on the real estate market.

"A non-revalued property is a property that is taxed at 15% while a revalued property is 5%, of course there is a difference. We have had a very dynamic market in recent years that we can say that certain areas and properties have doubled, which is quite a high doubling value. Today we find it impossible to find a property for a client who has credit. Since it was announced that the revaluation would be carried out, we have had a halt in sales. This is called a tax and it belongs to the seller because he is the owner of the property, but today all these costs go to the buyer," said Demirxhiu.

The expert also emphasized that, although the tax falls on the seller as the owner of the property, the costs are currently being passed on to the buyer.

The reform is expected to bring further effects on the real estate market in the coming months, while market actors expect greater clarification of the procedures and real impact of the new scheme.

Happening now...

Karmën nuk e ndalon dot Sali Berisha!

ideas

"Topple" Edi Rama by lying to yourself...

Only accepting Berisha's truths will save the DP from final extinction!

top

Alfa recipes

TRENDING

services

- POLICE129

- STREET POLICE126

- AMBULANCE112

- FIREFIGHTER128